VisMin Micro Entrepreneurs see opportunities with Cash Agad

Cash Agad agents help ensure resilient growth in far-flung VisMin communities

For decades, residents in far-flung areas in Visayas and Mindanao have been burdened by minimal, if not, right lack of access to banks. Many have to travel many kilometers, travel for hours, and spend about a hundred (or more) pesos just to get cash from a bank or ATM. This situation though has been slowly changing with the Cash Agad service.

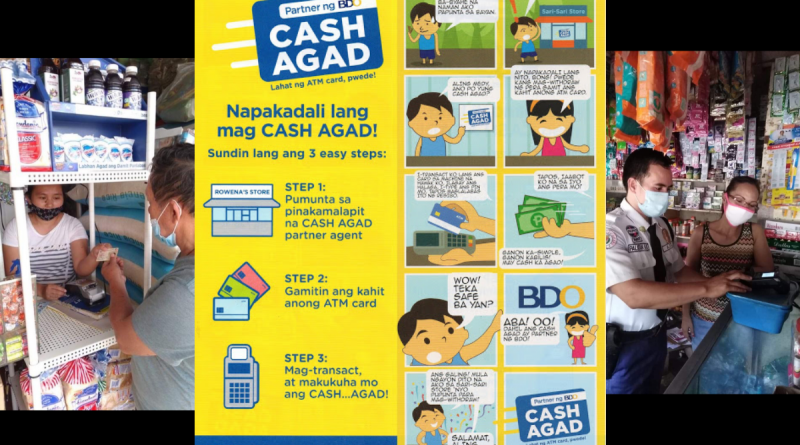

Cash Agad, which has been operating in both far-flung and semi-urban communities for the past several years, is allowing residents to make cash withdrawals, receive remittances and government cash subsidies, make balance inquiries, and get access to calamity funds and loan releases.

Cash Agad is a service that turns community-based shops like sari-sari stores into a neighborhood ATM. It was BDO Unibank Inc. that first originated the idea for such a service and has been expanding the Cash Agad network in the countryside ever since. The service accepts ATM cards, whether debit or prepaid cards from all banks in the Philippines.

According to Cash Agad partner agent Elsa Pardo of Lantapan, a municipality in Bukidnon Province, Mindanao, until today there’s just one single bank operating in their community. When the bank’s ATM runs out of cash or is in need of repair, people will have to wait and endure a few days without cash. Those who can’t afford to wait would have to go to the nearest urban area which is some 14 kilometers away. Transport fares can get quite expensive.

According to Elsa, sometimes even these other ATMs also run out of cash or go offline. In such cases, people would have to return home and go back the following day. This situation got even worse when quarantines were imposed due to COVID-19.

“Mahirap dito noong nagka-quarantine. Hindi makalabas yung mga tao. Kaya sabi nila, it’s a good thing there’s Cash Agad. Kasi mas madali na sa kanila mag-withdraw ng pera. Kung pupunta pa sila sa malayo, madami pang aasikasuhing requirements. Kailangan pa ng quarantine pass. Travel pass. Very inconvenient. Pag dito sa Cash Agad, malapit lang tapos makukuha pa agad yung pera. Sandali lang ang queueing time,” Elsa explained.

Elsa runs her Cash Agad service at her store in their municipality’s public market. When the pandemic hit and community quarantine was declared, she worked with the local government so that Cash Agad transactions could be done safely and in compliance with physical distancing regulations.

With the help of the LGU, protocols were set on how Cash Agad could provide services to its customers. Elsa’s customers include not only workers but also beneficiaries of 4Ps program (who receive monthly cash assistance from the government), and members of indigenous peoples (IPs) sector who also get cash assistance.

“Yung LGU po, they already set a schedule for withdrawals for 4Ps and assistance to IPs. So, these people already have set days and times when they can queue for withdrawals. They are also informed on how much money they are set to receive. Kaya hindi na nila kailangan mag-balance inquiry. Withdraw na agad using their ATMs,” Elsa explained.

“People were glad that we had this system because they felt safer and they were able to inquire about their balance, withdraw their salaries and remittances, and even get their loans and calamity assistance from the SSS and Pag-Ibig. Marami kasing nag-apply ng calamity loan during quarantine,” she said.

Spark for growth

Other Cash Agad partners in other localities report the same thing. This shows that by giving more people in more communities ready access to cash, the local economy benefits from the increased spending and capital flow.

“Financial inclusion in far-flung communities is a driver for economic growth. Some places are too far away or located in terrain that make it difficult, logistically, to build a bank branch. Take for example some islands or mountainous regions. That’s why innovative services like Cash Agad are a way to bridge the gap. As more spending occurs in a community, the better for residents and businesses,” said Jim Nasol, Head of Agency Banking, BDO.

As we face a public health and economic crisis, it’s evident how crucial Cash Agad is for people’s survival. They would otherwise not be able to get money for their essential needs. Cash Agad provides convenience but it can be a literal lifeline to those who depend on it. We’ve seen that during quarantine but the truth is, Cash Agad has become essential to communities whether there’s a pandemic or not.

For more information about Cash Agad and how it benefits Cash Agad partner agents and their communities, visit www.bdo.com.ph/cash-agad or email cashagad@bdo.com.ph.